Panoramic analysis of lidar industry chain

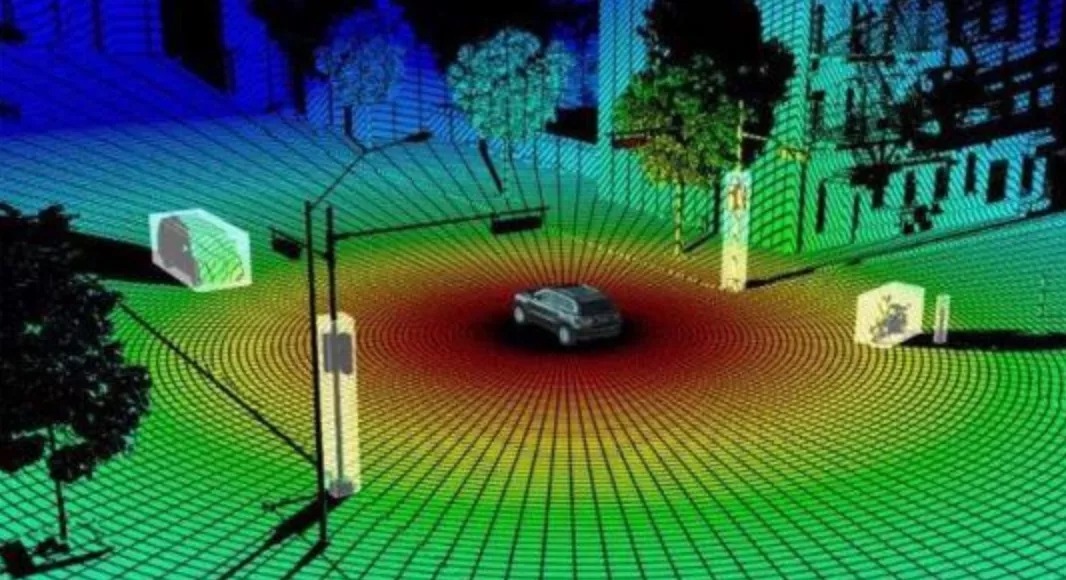

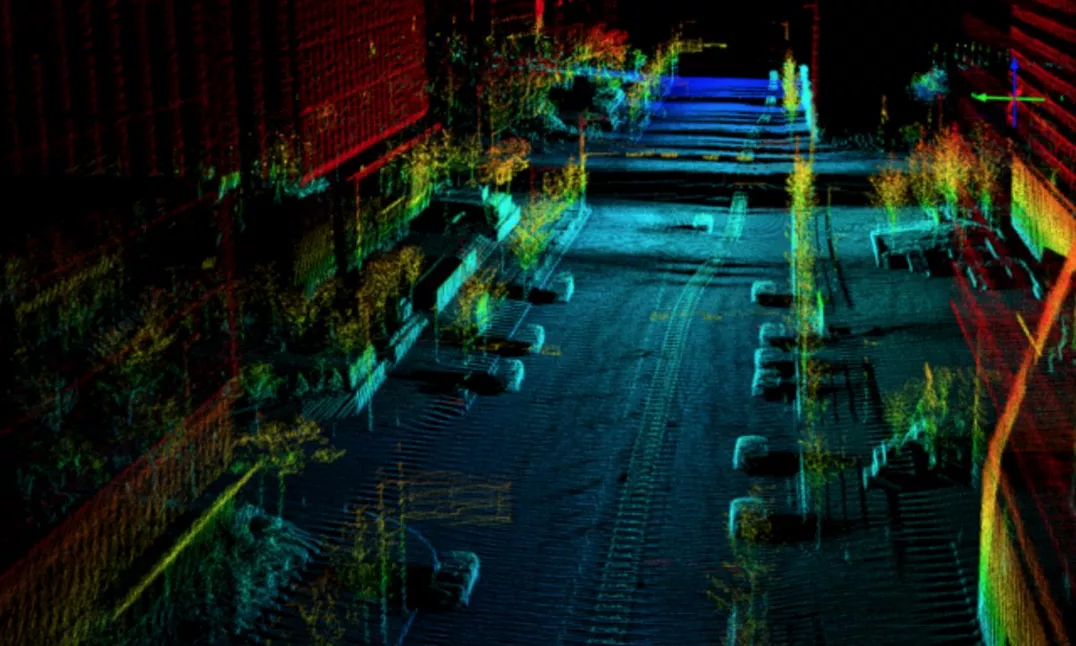

Lidar is a kind of sensor that uses laser to realize accurate ranging. In a broad sense, it can be regarded as a camera with 3D depth information. It is known as "the eye of robot".

Since its birth, lidar industry has closely followed the cutting-edge development of underlying devices, showing the outstanding characteristics of high technical level.

From the single point lidar at the beginning of the invention of laser to the later single line scanning lidar, and the multi line scanning lidar widely recognized in driverless technology, to the solid-state lidar and FMCW lidar with innovative technical schemes, and the continuous development towards chip and array in recent years, lidar has always been the representative of the development and application of emerging technologies.

In 2020, the national development and Reform Commission officially identified the seven sectors of "new infrastructure" for the first time. As a terminal sensor device, lidar plays an increasingly prominent role in intelligent transportation and smart city fields such as automatic driving and vehicle road coordination. The Chinese government's support for autonomous driving will also play a positive role in promoting the development of the global lidar industry. According to Sullivan's statistics and prediction, the global market scale of lidar will be US $13.54 billion by 2025, which can achieve a compound annual growth rate of 64.5% compared with 2019. By 2025, China's lidar market will reach US $4.31 billion, with an average annual compound growth rate of 63.1% compared with 2019.

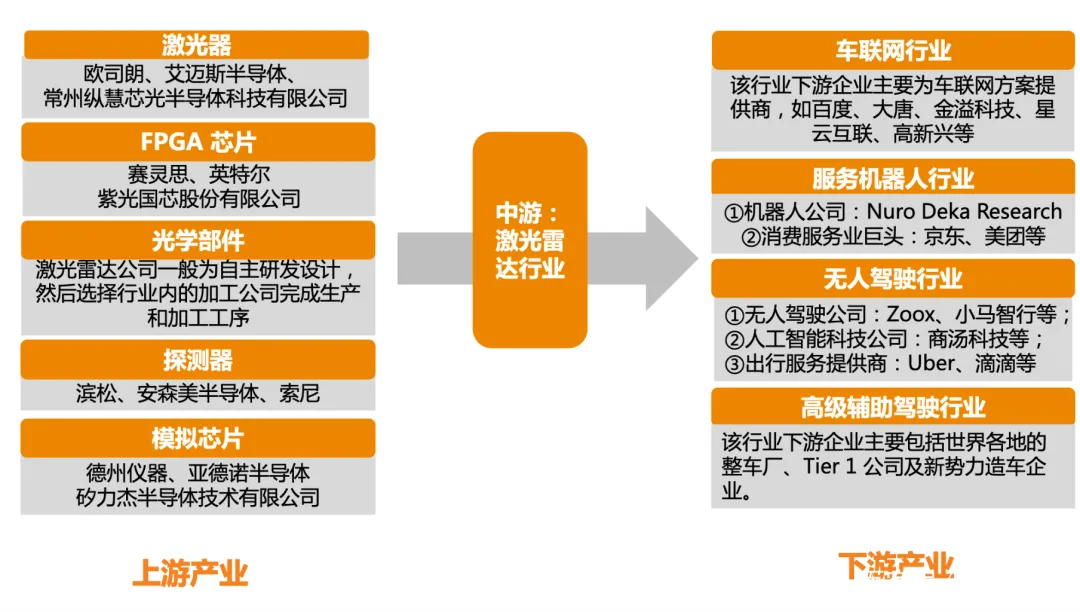

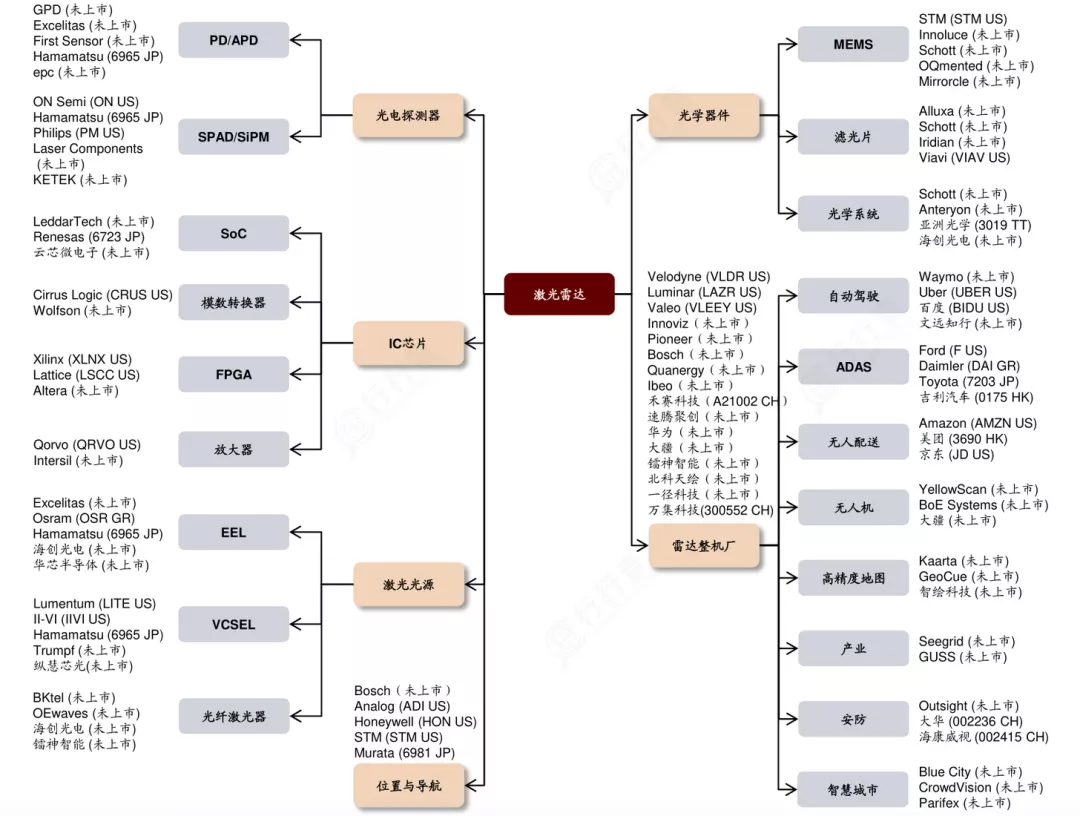

01. Lidar industry chain

From the perspective of industrial chain, the link where lidar is located has accumulated a lot of value and has strong industrial added value. As a new radar technology with high popularity in recent years, lidar technology has precise and complex system structure, sensitive and accurate equipment design requirements, multi module pays attention to high cooperation in work and operation, and high-precision mechanical equipment is required in the production process. Under such high standards and specifications, the production, manufacturing and R & D of lidar has great technical barriers to enterprises, and the early investment is not easy to produce obvious results. Lidar is the core component of downstream navigation, mapping and other applications. At present, the scarcity of production capacity leads to short supply, presents the seller's market and has strong pricing power for the downstream. Therefore, the main added value of the industrial chain lies in the lidar part, and the overall profit space of the industry is large.

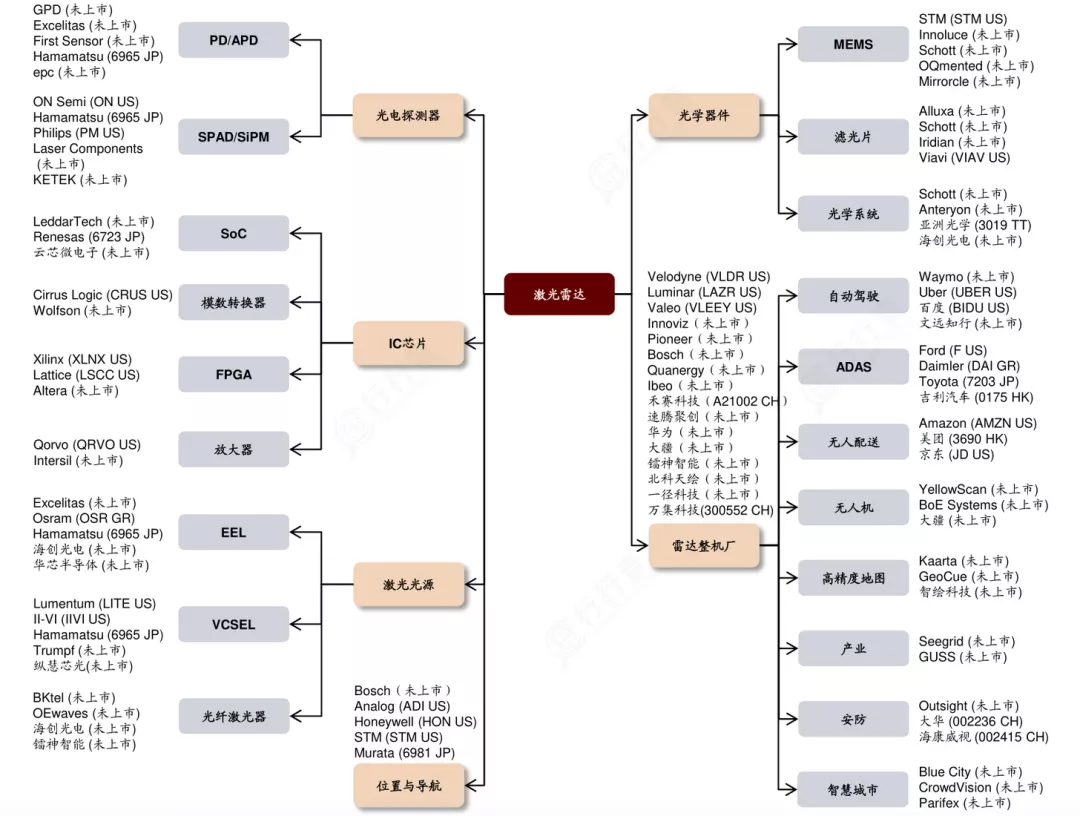

Lidar drives the competition of relevant industrial chains.

At present, the core components of global lidar include laser (such as solid-state laser, semiconductor laser, gas laser, etc.), scanner (such as scanning mirror, rotating motor, etc.), photodetector (such as silicon photomultiplier tube, avalanche photodiode, CCD / CIS, etc.), receiver IC (such as amplifier, analog-to-digital converter, FPGA, etc.), position and navigation system (GPS, IMU). Among them, the leading component suppliers are mainly concentrated in Europe and the United States.

Lidar upstream

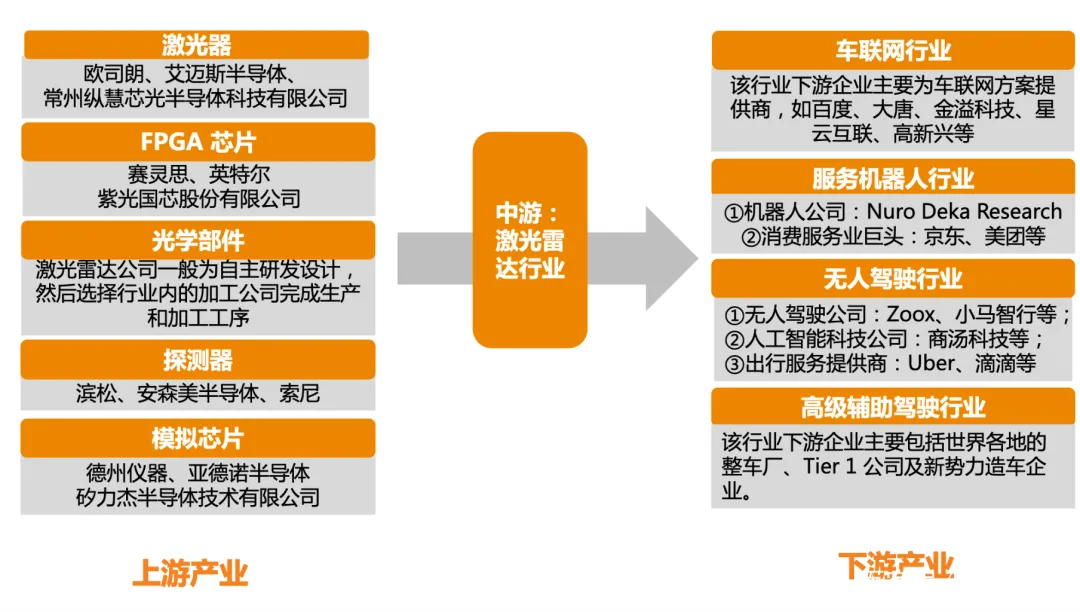

The upstream of lidar mainly includes four parts: laser emission, laser reception, scanning system and information processing. A large number of optical and electronic components in these four parts constitute the basis of lidar. Upstream core component manufacturers, whether optical components or electronic components, are involved in the processing and manufacturing of precision instruments and chips. At present, they are basically monopolized by large foreign manufacturers. In recent years, domestic manufacturers have also made breakthroughs in the field of upstream core components through self-research. For example, a number of Chinese entrepreneurial enterprises have emerged in the fields of scanning system, laser and light source receiver. In addition, the lidar chips in the Chinese market, especially the components required for signal processing, mainly rely on imports, which raises the production cost of lidar to a certain extent. Therefore, many domestic chip enterprises are striving to fill the gap in this field in the domestic market through their own advantageous technologies.

Main upstream manufacturers of lidar:

Source: Autobots reference

Lidar midstream

The middle reaches of lidar can be divided into vehicle lidar and logistics transportation lidar. Yole expects that lidar application is one of the fastest growing industries in the automotive industry. In terms of shipment volume, yole predicts that the global shipment volume of lidar will be about 23.9 million in 2030. There are many suppliers of vehicle lidar, including velodyne, lidar, vales, ibeo, Continental, etc. Manufacturers of industrial and logistics transportation lasers include sick, hokuyo, Omron, velodynelidar, Konica Minolta, etc.

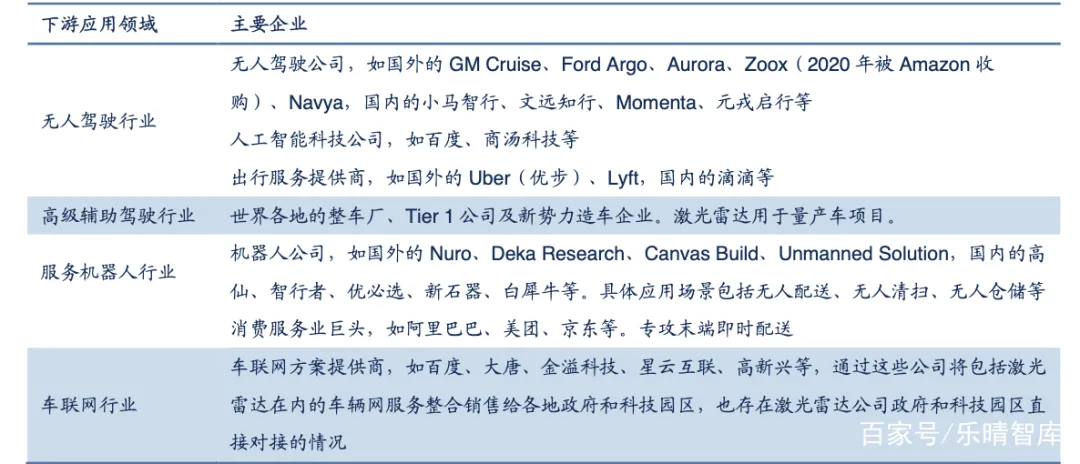

Lidar downstream

Lidar is widely used downstream, which can be divided into driverless industry, ADAS industry, service robot industry, vehicle networking industry, etc. Driven by the "new four modernizations" of "electrification, sharing, networking and intelligence" of the automobile industry, various industries are developing at a high speed. Lidar is the key to the realization of unmanned technology. Compared with millimeter wave radar and ultrasonic radar, it has the highest measurement accuracy, fast response speed and absolute advantages in operation performance.

The landing of unmanned service depends on the high-precision sensing information provided by lidar. Moreover, the environmental perception ability of lidar can expand the existing auxiliary driving function and improve vehicle safety, which provides important support for the advanced auxiliary driving industry for vehicle manufacturers and Tier1 company.

Although it is not as widely used in L2 and L3 vehicles as ultrasonic radar and millimeter wave radar, most vehicle manufacturers and Tier1 believe that lidar will become a necessary sensor for autonomous vehicle above L3 level, and eventually become a core sensor in autonomous vehicle above L4 level. At the same time, lidar technology has also promoted the rise of service-oriented robot industry and vehicle networking industry. Service-oriented robots realize functions such as unmanned distribution and unmanned cleaning by giving robots the ability of intelligent perception. Vehicle networking realizes safer, comfortable and intelligent transportation services through the interconnection between vehicles, vehicles and roads, vehicles and cloud platforms.

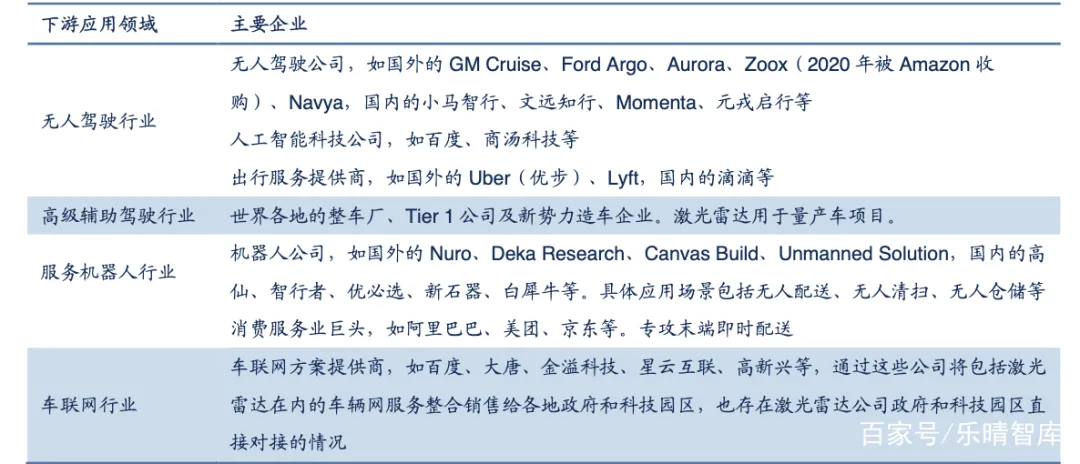

Major enterprises in lidar downstream industry chain:

Data source: prospectus of Hesai technology, Cinda securities

Lidar competition pattern

The global market of lidar has been gradually opened in recent years. Overseas manufacturers have the advantage of leading in the upstream and midstream, and are ahead of domestic manufacturers in terms of technology and customer base. However, domestic manufacturers have made many breakthroughs in recent years, and Chinese forces are gradually rising.

Foreign lidar technology began to be applied to ADAS assisted obstacle avoidance and navigation projects as early as 2010. As the representative of the core sensor of automatic driving in the future, the core technology of lidar is mainly mastered by three foreign enterprises: velodyne, quanergy and ibeo. Velodyne was founded in 1983. Its mechanical lidar started earlier and has advanced technology. At the same time, it has established cooperative relations with global automatic driving leading enterprises such as Google, general motors, Ford, Uber and Baidu, occupying most of the market share of vehicle lidar.

Quanergy was founded in 2012 and launched its first product m8-1 in 2014, which has been applied to the experimental models of Mercedes Benz, Hyundai and other companies. After M8, quanergy's successively released products began to take the solid-state route and adopted OPA optical phased array technology, which will significantly reduce the sensor price after mass production. Ibeo, founded in 1998, is the first enterprise in the world to have a vehicle scale lidar. It launched an all solid-state lidar A-Sample prototype in 2017.

After the rise of the wave of automatic driving in recent years, domestic lidar manufacturers have gradually entered the market. In the early stage, domestic players are divided into two schools: one is to develop mechanical lidar and old players such as velodyne to grab the market, and the other is to directly lock in solid-state lidar products, with the goal of landing in the front-end market after 2020.

Domestic enterprises such as Suteng juchuang, Hesai technology, Beike Tianhua and radium intelligence have risen successively. The domestic market competition is fierce, showing a market pattern in which a hundred flowers bloom.

On board lidar industry chain:

Data source: Bloomberg, CICC

Comparing Hesai technology and Suteng juchuang, their product positioning is also quite different. In the field of high-speed automatic driving (compared with low-speed unmanned vehicles), Hesai has a high market share, which is used by Baidu, Wen yuanzhixing, autox, Yuanrong Qihang and other companies.

In the field of low-speed automatic driving, Suteng juchuang is the main player. Neolithic, Jingdong, rookie logistics, Gaoxian robot and other companies mainly use Suteng's 16 line lidar products. At the same time, its 16 line and 32 line products are also adopted by some high-speed automatic driving companies such as Tucson future, yingche Technology and autox. On the other hand, with the gradual mass production of L3 level autonomous passenger vehicles from 2020, the market demand for vehicle specification level solid-state lidar will usher in a small climax. Consumer electronics hardware giants such as Dajiang and Huawei have come up with their own new lidar products and directly joined the battle of front loading mass production and loading. In August 2020, Dajiang announced that the company was the first to reduce the price of auto driving lidar to 1000 yuan, and energy production and supply. Lanwo technology, an incubation brand of Dajiang, also released two high-performance lidar sensors in ces in the United States.

On April 17, 2021, the new generation of intelligent luxury pure electric car arcfox alpha s was officially released in Shanghai. According to the official website of the press conference, BAIC Blue Valley arcfox is extremely fox α Shbt model adopts three laser radar carrying scheme, which is synchronously equipped with 6 millimeter wave radars, 12 cameras and 13 ultrasonic radars. At the same time, it is equipped with Huawei chip with computing power up to 352tops, forming an automatic driving solution above L3 level. Milestone of Huawei lidar's "climbing the north slope strategy": in 2016, Huawei carried out the technical pre research of lidar, carried out prototype verification in 2017, signed a strategic cooperation agreement with top vehicle enterprises in 2019, and achieved mass production in 2020.

Representative manufacturers of lidar industry chain:

Source: mcmus consulting

The future lidar technology is mainly based on TOF and FMCW principles. For lidar based on TOF principle, the chip based lidar is the future development direction. The transmitting end gradually adopts planar laser devices, the receiving end gradually adopts CMOS single photon detector, and the analog and digital chips developed for VCSEL and single photon devices; Silicon optical chip based FMCW lidar is a major trend in the future.

The development of lidar will promote the development of driverless technology and ADAS in the automotive industry, and will also improve the application scope and popularity of service robots.

In the future, with the further popularization of automatic driving technology, the market scale of lidar will be further expanded, and the decline of single vehicle value will further facilitate the mass production and use of lidar. With the gradual popularization of artificial intelligence and 5g technology, driven by the demand of driverless, ADAS, service robot and vehicle networking, the overall market of lidar is expected to show a high-speed development trend.